Inventory depreciation calculator

You can browse through general categories of items or begin with a keyword search. Salvage Value of the Asset.

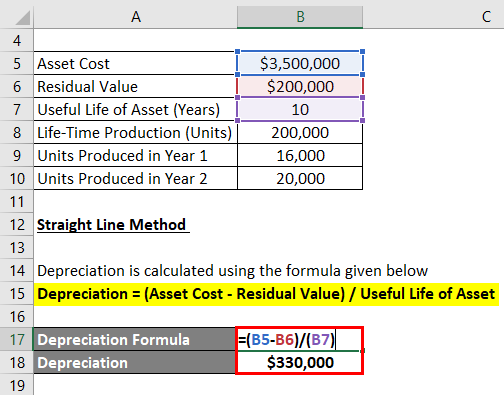

Depreciation Formula Examples With Excel Template

All you need to do is.

. Inventory depreciation expense for August using a 15 depreciation in 000 Purchases COGS June 40 60 80 July 20 100 30 August. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. It is fairly simple to use.

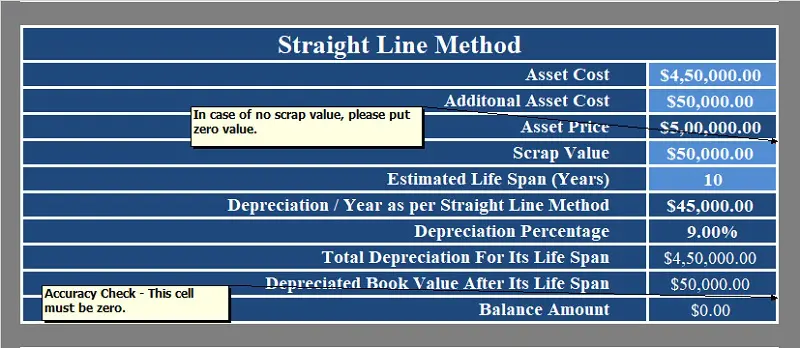

Annual and monthly straight-line. Depreciation for any period. Depreciation Calculator is a ready-to-use excel template to calculate Straight-Line as well as Diminishing Balance Depreciation on TangibleFixed Assets.

The calculator should be used as a general guide only. The formula to calculate annual depreciation. Inventory turnover ratio Cost of the.

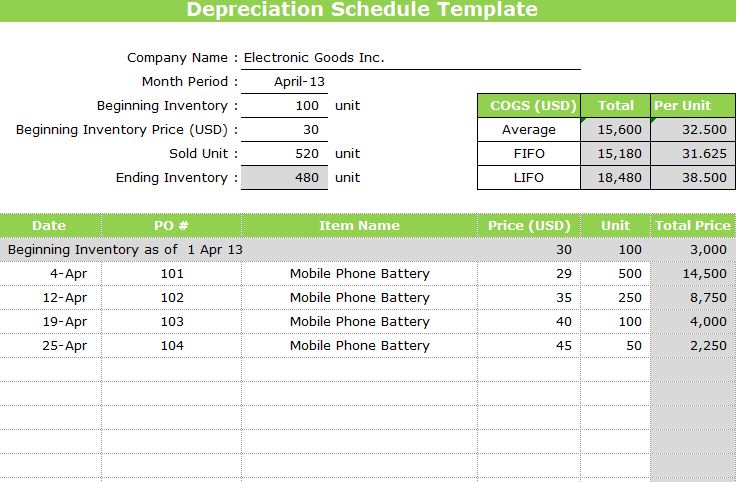

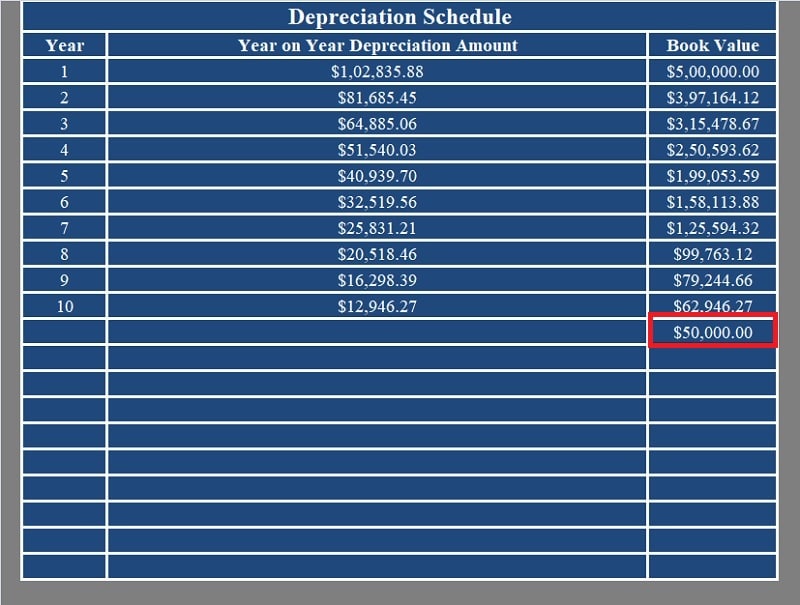

Inventory is one of the biggest expenses for many companies so its important to accurately calculate the cost of holding that inventory as well. This depreciation calculator is for calculating the depreciation schedule of an asset. Useful Life in Yrs.

The calculator also estimates the first year and the total vehicle depreciation. Percentage Declining Balance Depreciation Calculator. Double declining balance Book value of the asset times.

Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance. The algorithm of this inventory turnover ratio calculator applies the equations explained here while it returns the results presented in the next rows. Also includes a specialized real estate property calculator.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. For example if you have. The most common methods used of accounting for depreciation are.

Calculate the annual depreciation Ali should book for 5 years. First one can choose the straight line method of. Select the currency from the drop-down list optional Enter the.

Asset Depreciation - straight Line Method Calculator. Initial cost of asset. Keep an inventory of your capital equipment at your business locations with this equipment inventory and depreciation schedule template.

There are many variables which can affect an items life expectancy that should be taken into consideration when determining actual cash. He plans to sell the scrap at the end of its useful life of 5 years for 50. The template displays the.

Straight-line depreciation Cost of asset assets years of life. It provides a couple different methods of depreciation. The Depreciation Calculator computes the value of an item based its age and replacement value.

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Macrs Depreciation Calculator With Formula Nerd Counter

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Definition Formula

Depreciation Schedule Template Depreciation Schedule Excel

Depreciation Formula Examples With Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Examples With Excel Template

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Inventory Formula Inventory Calculator Excel Template

What Is Accumulated Depreciation How It Works And Why You Need It

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Methods Principlesofaccounting Com

Download Depreciation Calculator Excel Template Exceldatapro